Here are some of the key features of TCJA that will have an impact on your taxes effective January 1, 2018. Most of these changes are effective until December 31, 2025. This article was written by Kislay (Sal) Shah. Mr. Shah has been in practice for over 25 years.

Personal Exemption

No personal exemptions are allowed through 2025.

Standard Deductions have increased

Standard Deductions have increased significantly. For individual filers standard deduction is $12,000 (from $6,350), for head of house hold $18,000 (from $9,350), married filing jointly $24,000 (from $12,700). This may mean that many tax payers may not itemize their deductions and use standard deduction instead (the higher amount).

State and Local Tax (SALT) Deduction

All taxpayers can itemize upto $10,000 maximum of total of all state and local income taxes, sales and property tax. This rule is valid until 2025. This limitation had been a point of discussion in states where the property and income taxes are high. But the counter argument is that the lower tax brackets (discussed below) will more than offset this loss of deduction.

Tax rates a comparison

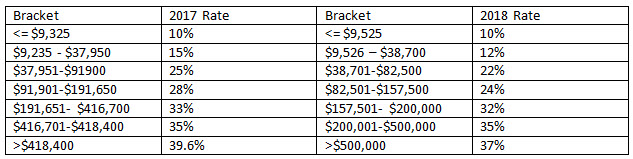

TCJA has increased tax rates. For individual the new rates and brackets are as follows:

Bracket 2017 Rate Bracket 2018 Rate

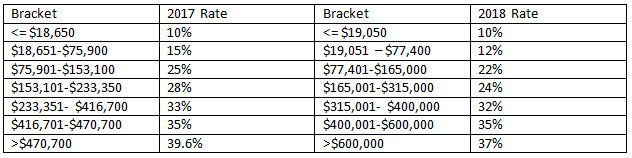

For taxpayers who are married filing jointly and surviving spouse

Bracket 2017 Rate Bracket 2018 Rate

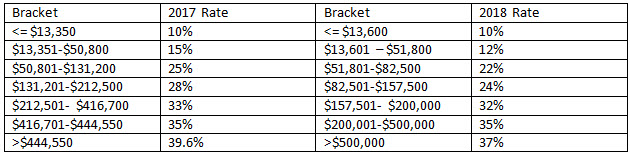

Head of Household

Bracket 2017 Rate Bracket 2018 Rate

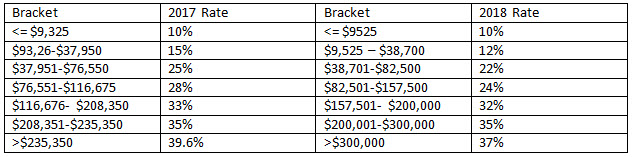

Married Filing Separately

Bracket 2017 Rate Bracket 2018 Rate

Detail tax table can be obtained fromhttps://www.irs.gov/pub/irs-pdf/i1040tt.pdf

Alternate Minimum Taxes (AMT) exemption amount increased

AMT exemption has been increased to income level of $70,300 (from $54,700, for married filing jointly $109,400. The phase out of AMT has been increased to $500,000 for individuals and $1,000,000 for joint filers.

Alimony

Alimony payments/receipts are no longer reportable if the payments are based on a divorce or separation agreement executed or modified after December 31, 2018.

Child Tax Credit

Child tax credit has been doubled to $2,000 per qualifying child. Of the amount upto $1,400 can be claimed as a refundable credit and upto $500 as unrefundable. The credit beings to be phased out at $200,000 of Adjustable Gross Income (AGI), or $400,000 for married filing jointly.

Deduction for interest on home mortgage and home equity loans have been modified

For itemized deduction, Interest on mortgage loans existing on or before December 15, 2017 if the principal amount does not exceed $1 million, and if refinanced it does not exceed the total debt amount. For new home owners the principal amount of loan is limited to $750,000. Please refer to IRS publication 5307 for some example scenarios of home loans and their usages.

Gain on sale of home

Home owners can still deduct gains upto $250,000 (or $500,000 if married filing jointly) for their primary residence. However, for sales after December 31, 2017 the use as primary residence has been increased to five out of eight previous years from two out of five previous years.

Medical Expenses

Itemized deduction for all taxpayers for medical expenses has been reduced to 7.5% of AGI.

Moving Expenses

Itemized deduction for moving expenses have been eliminated for all taxpayers except members of the military.

Miscellaneous tax deductions

These are itemized deductions that are allowed when in total they exceed 2% of AGI. However, TCJA has made the following major changes:

Tax preparation expenses are not deductible.

Unreimbursed business expenses for example, use of home office, job-search, professional license fees, etc. are not deductible.

Investment fees are no longer deductible.

Personal Casualty and Theft deductions

Personal casualty and theft expenses are deductible only related to federally declared disaster.

ABLE accounts and Rollover from a 529 Plan

A taxpayer can contribute more to Achieving a better Life Experience (ABLE) and may also rollover limited amounts from a 529 qualified tuition program account of the designated beneficiary to the ABLE account of the designated beneficiary to their family member.

TCJA now effective January 1, 2018 allows distributions from 529 plans upto $10,000 of tuition per beneficiary each year to an elementary or secondary (k-12) school.

For any questions you may contact Kislay (Sal) Shah at kislay@shahcpaus.com or call 917-991-1453.

You can get more detail on any of the topics discussed above from IRS website at https://www.irs.gov/pub/irs-pdf/p5307.pdf and irs.gov which are the primary source of information for this article.