Valuation Challenge for PE/VCs in Fourth Quarter of 2018

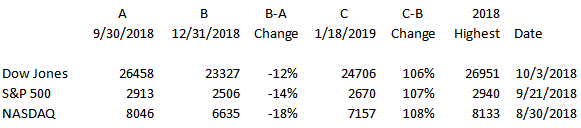

Here is the challenge that Private Equity (PE) and Venture Capital (VC) Funds would face in valuing their portfolios at December 31, 2018. PE and VC funds using income approach, market comparable and/or precedent transaction approach to valuing their portfolios on a periodic basis, usually quarterly, may have been looking at higher market multiples in their models until September 30, 2018 as compared to December 31, 2018. Though prior multiples may be considered high, none the less, they were market observable inputs. In December, the US market took one of its steepest dives and remained low for the year end market close at December 31, 2018. The markets have since bounced back. Below is a quick summary of market moments.

refer to www.wsj.com

The investment managers, valuation experts, auditors and regulators may be obligated to consider the comparable company multiples at December 31, 2018 in accordance with Accounting Principles Generally Accepted in United States (GAAP). However, they would also need to consider how the market volatility is impacting their subject company valuation models. Or do they need to consider a different multiple for quarter (September 30, 2018) over quarter (December 31, 2018) modeling. Perhaps consider a lower discount or a higher premium at December 31, 2018 as compared to previous quarters. They need to justify and document their conclusions. Subsequent to December 31, 2018 bounce back of the market indices and the related public company comparable may be a factor to consider as well. The facts would differ based on company specific and industry factors. Please note that the AICPA Accounting Standards Code 820 does require fair value to be representative of market participant exit price at each measurement date. Interested parties should consider consulting with their experts and see how they can get guidance from recently issued AICPA PE/VC Task Force and AICPA staff developed working draft, which was reviewed and approved by the AICPA Financial Reporting Executive Committee.

This blog was written by Kislay (Sal) Shah. Mr. Shah has been in public accounting practice for over 25 years. For any questions you can reach Shah at kislay@shahcpaus.com