Form 8938 Versus FinCEN Form 114

Figuring out which forms need to be filled out to report your foreign accounts and assets can be a daunting task. There are many rules and regulations that need to be taken into consideration to ensure that no penalties are accrued. Consulting with your accountant can guarantee that time isn’t wasted filing unnecessary forms or claiming assets that are not pertinent to the form(s) but that mandatory reports are appropriately filled out.

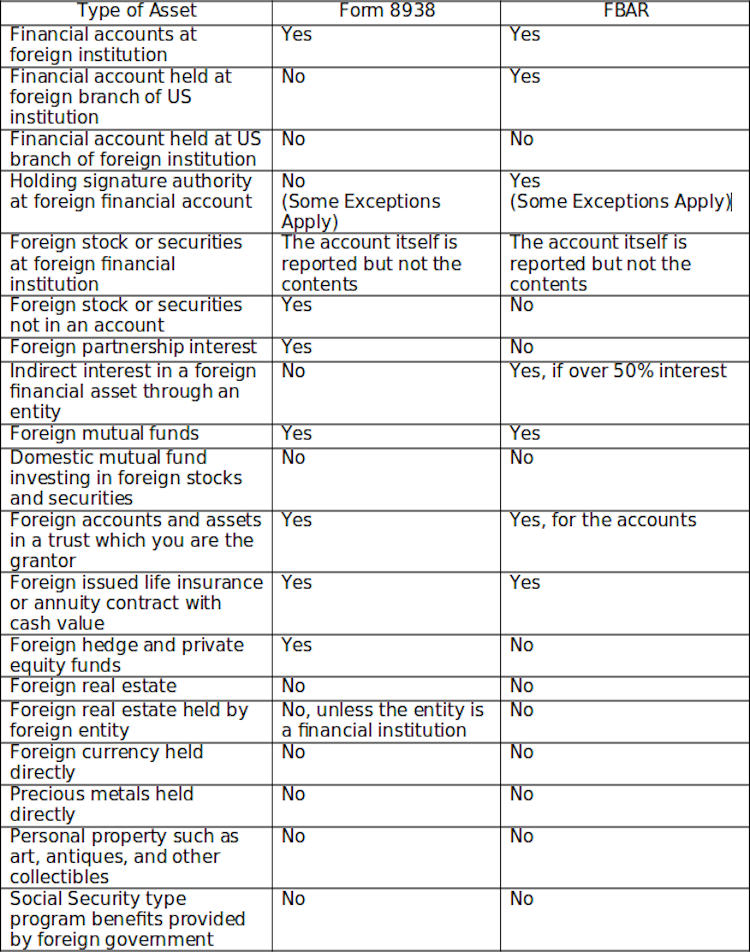

Certain foreign financial accounts and other assets must be reported to federal agencies to assist in preventing tax evasion. Depending on the type and value of the account will determine which, if not both, forms need to be filled out. The FBAR (Report of Foreign Bank and Financial Accounts), FinCEN (Financial Crimes Enforcement Network) Form 114, was established in 1970 and is not filed with the IRS. However, Form 8938, created for the 2011 tax year, is reported to the IRS. While they are similar, they each have their own requirements for who must report and what is reported. Kislay Shah CPA is an experienced firm in this field that can certify your reports so that everything is justly filed.

Who Must File?

Filing Form 8938 varies on the individual’s tax filing status and physical location. If a person files as single/unmarried and is in the United States, they must file if their account balance exceeds $50,000 on the last day of the tax year or if it exceeds $75,000 at any point in the year. The same tax filing status outside of the U.S. must report if their balance is $200,000 at the end of the year or surpasses $300,000 at any point. Married tax filers have a different set of limits. Those within the states and filing together must not have a balance over $100,000 at the end of the year or over $150,000 throughout the year, and those outside of the states must not overstep a limit of $400,000 or $600,000, respectively. However, married couples that are filing individually also have their own set of guidelines to follow. If they reside within the United States, then their limitations are an end-of-year maximum of $50,000 or a peak of $75,000. Residence outside of the states increases the end-of-year maximum to $200,000 and a climax of $300,000. For the FBAR, filing status and location does not change limitations. If a tax filer has an account with a balance of $10,000, then they must file FinCEN Form 114. This includes an accumulation of accounts. For example, if the party of interest has three separate accounts in the amount of $4,000, the FBAR must be filed even though each account is under the $10,000 limit.

The type of interest in an account is also important. For Form 8938, direct ownership is indicative of needing to file. So, being a power of attorney or having signature authority does not dictate a need to file. Yet, with the FBAR, 50% ownership interest, power of attorney, or having signature authority will indicate a need to file with FinCEN.

As mentioned previously, location will indicate limits and a need to file. While most people think of tax filers residing in the United States, the territories are also included depending on which form is filed. The United States also has territories including Puerto Rico, American Samoa, Guam, Virgin Islands, and Northern Mariana Islands. The filer’s residency will control which form is applicable. With Form 8938, residency within the United States, Puerto Rico, and American Samoa indicates a need to file, but those residing in Guam, Virgin Islands, or Northern Mariana Islands do not need to file Form 8938. However, for the FBAR form, residing in any of the territories mentioned earlier dictates filing with FinCEN. The location of the finance account matters as well (Versus the residency of the account holder). If the financial account is within any of the territories, Form 8938 still needs to be filed, yet, the FBAR does not need to be filed if the account is within one of these locations. Furthermore, as example, if an American bank account is on foreign soil, Form 8938 does not need to be filed, but FinCEN Form 114 still needs to be documented.

Examples of When to File

Filing Forms

Form 1040, an individual’s tax return, includes Form 8938, and, therefore, is filed with your taxes to the IRS by the yearly deadline. However, the FBAR is not filed with Form 1040 to the IRS and is instead electronically filed with FinCEN by April 15th or the extension of October 15th. Since the FBAR is not filed with the IRS, it is not automatically reviewed when placed under audit per the Internal Revenue Manual, but Form 8938 is evaluated. Any inconsistencies or discrepancies with Form 8938 during an audit may lead to an assessment of the FBAR.

While both forms do have their differences for filing requirements, the forms are very similar in nature and have the same goal. The pair both report on foreign accounts and assets in US dollars per the end-of-year exchange rates. They also require that the value assigned to the reported accounts must match. When filing, it is imperative to list all accounts applicable, even if they are mentioned on the other form. Even accounts with smaller values should be mentioned since the accumulative balance makes a difference.

Penalties are assessed for failure to disclose information for both forms. Form 8938 penalizes up to $10,000 and additionally, up to $10,000 per 30 days after the IRS notifies the filer of failure to do so. With FinCEN Form 114, penalties are adjusted each year for inflation. For the civil penalty assessment, a non-willful fee is up to $10,000, but, if willful, up to $100,000 or 50% of the account balance, whichever is greater. Failure to file either form may cause enforcement of criminal penalties.

Due to the severity of failure to fully disclose and file forms, contacting your accountant is the best choice to guarantee the success of your finances. Without professional assistance, time and funding could be wasted. There are many intricacies that dictate filing either form, which is why contacting Kislay Shah is in your best interest to secure your financial future. You can reach Shah at

or call 646-328-1326.