Foreign Investments in the US – Tax Passage

Numerous residents explore foreign investments to expand their financial portfolios. These investments can be a great way to build your company when seeking resources, markets, efficiency, or different government policies that would benefit your business. When looking into foreign investments, it is important to be mindful of how the investments are structured, licensing obligations, various restrictions, taxes and withholdings on earnings, and the various filing requirements to keep your acquisitions legal and compliant. Contact your accountant when considering investments to take the correct actions to secure your finances.

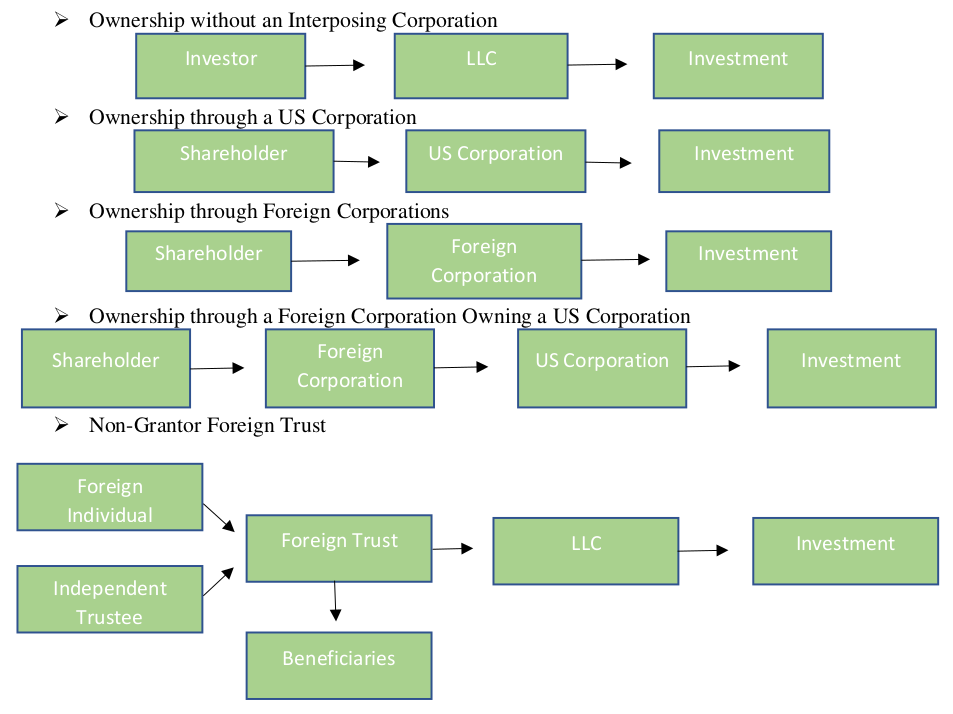

Ownership Structures for Investment

Foreign investments need to have a degree of privacy and accountability to provide legitimacy to the investor. There are two main, different structures to owning assets in the United States – direct and indirect ownership. Depending on personal needs, it will dictate which route is best for investment.

Direct investments refer to investments made directly into US assets. These investments provide investors with the ability to have full control and ownership of the asset, allowing them to make decisions on how the asset is managed and how the profits are used. Investing directly is advantageous because of its simplicity and solitary level of taxation. However, direct investments also come with greater risk, as the investor is solely responsible for any losses incurred on the investment. Also, investors are not protected from liability, and there is no privacy provided for them. Consequently, if legal action is brought, litigation will be directed toward the individual.

Indirect investments, on the other hand, are when the assets are owned through a corporation. This is beneficial because it provides greater privacy for the investor and protects against legal liability. To assist in privacy, it is ideal that an LLC or a trust under a generic name be utilized to acquire the assets, and if a trust is used to acquire the assets, the investor should not be listed as the trustee. Along with privacy, using an LLC helps provide protection for the investor and assets. Therefore, creditors cannot pursue assets through the investor but must go through the LLC, requiring more steps to be addressed before taking any action. Depending on whether it is a domestic or foreign corporation will determine other characteristics of what is entailed for the investor, such as regulations and taxes. Since ownership is through a corporation, they are subject to multiple layers of taxation and are more complex to manage

- Domestic Corporations will ensure that corporate-level taxes are paid, the dividends are subject to a 30% tax rate, and the shares from the company are a part of the US estate. Dividends paid by the domestic corporation to its shareholders are subject to double taxation, as the corporation must pay tax on the profit before distributing the dividends to the shareholders. The shareholders will then pay tax on the dividends they receive, resulting in double taxation.

- Foreign Corporations do not require a US tax filing, shares are not a part of the US estate, dividends are not taxed at 30%, stock holdings are not taxed or filed, and the gift tax does not apply. However, if the corporation participates in trading with the US, corporate taxes are filed, and it will be subject to the branch profits tax. The branch profits tax is a tax on the net income of a foreign corporation’s US branch. It is imposed at a rate of 30% of the corporation’s net income from the US branch. The corporation must also pay a state income tax, which can range from 0% to 12%.

Furthermore, there are numerous indirect ownership structures when considering investments. Each is utilized for its different features and benefits. Foreign investments can be structured through an offshore trust, a foreign corporation, or a foreign limited liability company. An offshore trust is a legal arrangement where a trustee holds legal title to assets for the benefit of one or more beneficiaries. A foreign corporation is a legal entity that is created under the laws of a foreign country. A foreign limited liability company is a business entity that is created under the laws of a foreign country and offers limited liability protection to its members. With the different legal and tax implications and management requirements for each structure, it is necessary to speak to your accountant to pick the right path.

Foreign Investors

Non-resident aliens (NRAs) are commonly seen as foreign investors in the United States. NRAs can be a person or a corporation who is:

- Physically present in the US for less than 183 days (about 6 months) in any year

- Physically present in the US for less than 31 days (about 1 month) in the current year

- Physically present in the US for less than 183 days over a three-year period (using a formula)

- Does not hold a permanent residence status (Green card or EB-5)

If the foreigner holds a Green Card or is deemed a resident based on the number of days listed above, they will be considered a resident from that day forward for the calendar year.

Income taxes pertaining to non-resident alien investments have general rules to follow, but regulations compound quickly to instill confusion. Conventionally, a 30% tax rate is applied to NRAs on income that is provided by a US source. This income is commonly referred to as FDAP (fixed, determinable, annual, or periodical). The payor of FDAP is subject to a tax as well but may be reduced by a rate of 0-15%. The 30% tax rate is applied to the payment and withheld by the FDAP payor. Later, the taxes are remitted to the Treasury Department. Additionally, like other US taxpayers, the appropriate tax deductions will be applied to FDAP as well.

FIRTPA, Foreign Investment in Real Property Tax Act of 1980, is a tax applied to real estate sales from NRAs. This is applied in addition to the traditional taxes that apply to US taxpayers. 10% of the amount listed on the disposition is required to be held by the purchaser. So, when purchasing a home from an NRA, Form 8288 is filed and submitted with the 10% withheld from the purchase. There are some exceptions to this rule, but that is why it is important to consult with your accountant to ensure that regulations are followed appropriately. Furthermore, like other acquisitions, doing so through an LLC will benefit the NRA, especially when there is a potential to be subject to gift taxes.

Estate and Gift Taxes

A new set of guidelines are established for NRA qualification when looking into estate tax. As opposed to looking at a numerical count, they look at qualitative data for answers. They take numerous factors into consideration including voting, participation in the community, size and cost of US home, primary intent, location of family, participation in US business, length of stay in the US, frequency of travel, and ownership of assets in the US.

In addition, the NRA’s gross estate in the US at the time of death is subject to the estate tax at a 40% rate, but this may be revoked if the circumstances warrant. The estate tax applies to all US-situs property. This includes real estate located in the United States and tangible personal property but does not include things such as stock, bank accounts, and life insurance policies. Due to circumstantial fees, organizing your estate with your accountant is the best way to avoid and reduce fees associated with estate taxes.

Gift taxes are also commonly seen in estate planning. All gifts of US-situs assets, except for those that are intangible, are subject to this tax. Tangible gifts include personal and real property located in the US, but intangible gifts include assets such as interest in legal entities. Any gifts that are not physically located within the US are not eligible for gift taxes.

Having an estate plan is imperative, especially for those who own tangible assets in the United States. People who use foreign corporations to own US assets and those seeking an exemption from US gift tax must participate.

Forms and Fees

There are numerous forms that must be completed when engaging in foreign investments. For example, when funds are transferred out of the country, Form 926 must be completed. Furthermore, Form 8865 must be completed if engaging in foreign partnerships, while Form 5471 must be completed if investing with foreign corporations. These are just three of the multitude of forms that need to be addressed when making investments. If any of the forms are missed, penalties start at $10,000 per form, per year. This can lead to detrimental fees accrued that the investor now must pay instead of investing in their portfolio. It is important to consider the cost and resources necessary to operate a foreign corporation or limited liability company. Your accountant can help you weigh the pros and cons and make the best decision for your business.

Preparing For Your Investments

No matter your citizenship status, location of assets, or how the assets will be obtained, when looking to invest in an asset, consulting with an accountant is vital to your financial future. There are different guidelines and circumstances depending on each of the characteristics mentioned previously. The goal is to pick the right path for each situation to where every detail is noticed, and each portfolio is specialized to maximize its benefits. If you have further questions or need to schedule a consultation, feel free to contact Kislay Shah CPA at kislay@shahcpaus.com or call 646-328-1326.