Accounting for Healthcare Specialists

You wouldn’t trust your health in the hands of any doctor, so why would you trust any CPA to help maintain the well-being of your practice? Kislay Shah CPA has over 25 years of accounting expertise to analyze your healthcare practice’s situation, needs, and solutions to help you maximize the potential to care for your patients and what truly matters to you. We’ve assisted numerous healthcare practices and are able to accommodate the needs of:

Physicians- maximizing expense deductions, revenue billing, and collection

Practices with Multiple Specialties – revenue production by segment and expense allocation

Dentists – insurance, additional billings, and rules of depreciation for specialty equipment used

Hospitals – revenue recognition across services and departments and allocation of indirect expenses which include depreciation, physicians, and staff payroll

Chiropractors – daily operations and interactions with other services

Nurses – initial education deductions

Skilled Nursing Facilities – multiple specialties with a large need for space

Therapists – labor intensive days and the space needed to accommodate

& More

Pick a Healthcare Accountant

Just like a physical is important to your health to have performed regularly, it is imperative to consistently comb through your company’s finances to look for any inconsistencies to increase efficiency for your business. While many accountants solely look at the traditional income statement, we will take a more strategic approach to analyze a full breakdown of your business’s finances. We inspect the individual segments of income, the details of revenue adjustments, expense groups, and cost allocation. And, with our years of experience of working with other healthcare specialists, we are able to tailor each financial statement to fit the unique situation.

The Traditional Income Statement

The traditional income statement that most accountants use has a very simplistic broad picture layout- this itemizes by net production, total cash income, and net profit/loss. Typically, the income statement will cover these key elements:

Revenue – transactions, projects, services

Adjustments to revenue

Physicians – compensation and benefits

Expenses – direct and indirect overhead expenses such as rent, insurance, repairs, interest, depreciation, etc.

While this method does observe accounting standards, it only meets the basic requirements, and just like you wouldn’t settle for the bare minimum for your health, you shouldn’t for your practice either. In a traditional financial statement, after compensation to the physician owners, there is a net-zero income at the company level. With this net zero-profit approach, the practice meets the purpose of minimizing income taxes to the corporation. However, as we begin to look deeper into their financial breakdown, a different picture is painted that shows the true colors of the company and where improvement is needed. To truly look at this company’s finances, we have to examine their operational strategies, sources of revenue, and perform a thorough expenses review to analyze the management and strategic information for the business.

Our Strategic Approach

Our approach to your financial statements is strategic and enables our firm to take a deeper look at your company to help us recognize issues that are holding your company back and empowers you to make decisions that benefit the establishment. We recognize the following important aspects that need to be completed to ensure optimization of your financial records:

Revenue Production by Division and Adjustment

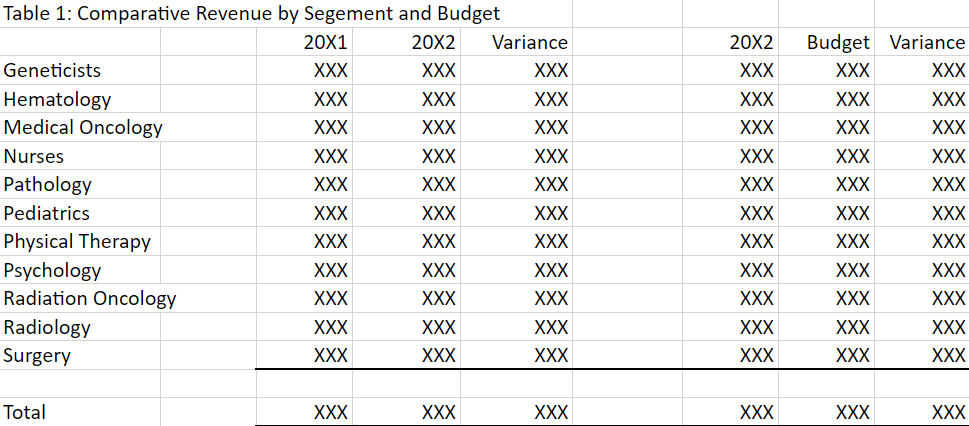

Separating and identifying where your profits come from is key in learning exactly which departments or physicians of your firm are growing, declining, and/or maintaining steady production. This allows you to help confirm forecasts, predict forecasts, and understand what changes may need to be made based off of which segment brings in what percentage of the revenue. When the income is separated into segments, we’re able to assess what actions may need to be taken to address the issues faced at the practice. Table 1 below is displaying the revenue segments of a cancer care facility which compares a year over year revenue by major segment or service class. Such a revenue statement helps to understand how revenue has changed year over year and how it compares to the budget. It is very helpful in making informed management decisions.

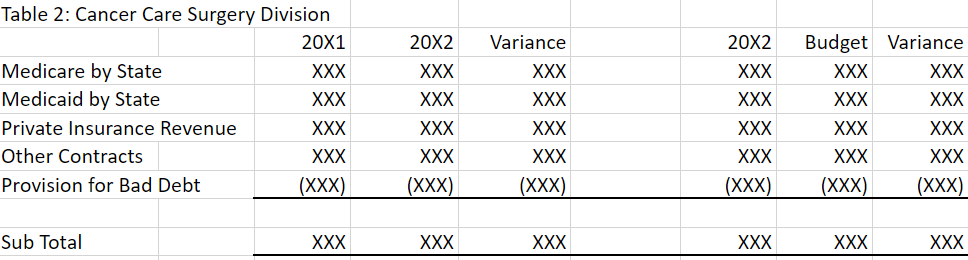

Table 2 below is an example of the Surgical division which was further sub-divided to look at the various revenue sources for the division. Determining major revenue division is a management decision which should be consistent with the medical specialty and correspond to the management budget. Reasons for the major variance can then be analyzed. Such timely analysis can help in rewarding the high performers and taking timely corrective for the laggards.

It would be amiss to speak about revenue budgeting and recognition and not consider what goes behind the billing. Generally, most services and procedures are billed based on pre-determined rates (Standard Rates). However, to the standard rates there maybe budgeted discounts – for example, discounts based on standard insurance rates (Medicaid, Medicare or Private) or contractual agreements. This analysis helps in understanding extraordinary and higher discounts taken on services provided. One big factor to consider is that once the fixed costs are recovered at a breakeven volume, additional volume or volume over budget can bring in additional profits. For example, unfavorable variance lowers the budgeted volume of patient care which may be identified as a cause. This can help management in taking corrective measures to look for additional ways to generate revenue or change its marketing strategy.

Expenses

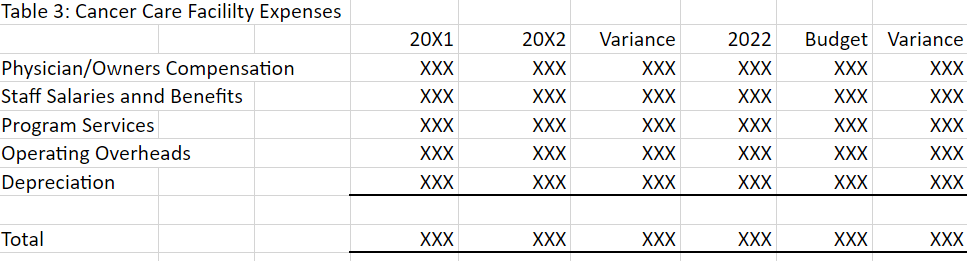

Table 3 below can provide management insight into various practice expense categories by segment which will provide management better insight into how the funds are utilized. The categories needed to identify cost vary by practice but are based on specialty, size, growth plans, and the details available. While expenses are already identified, categorizing them is relatively easy yet crucial.

Overhead Allocation

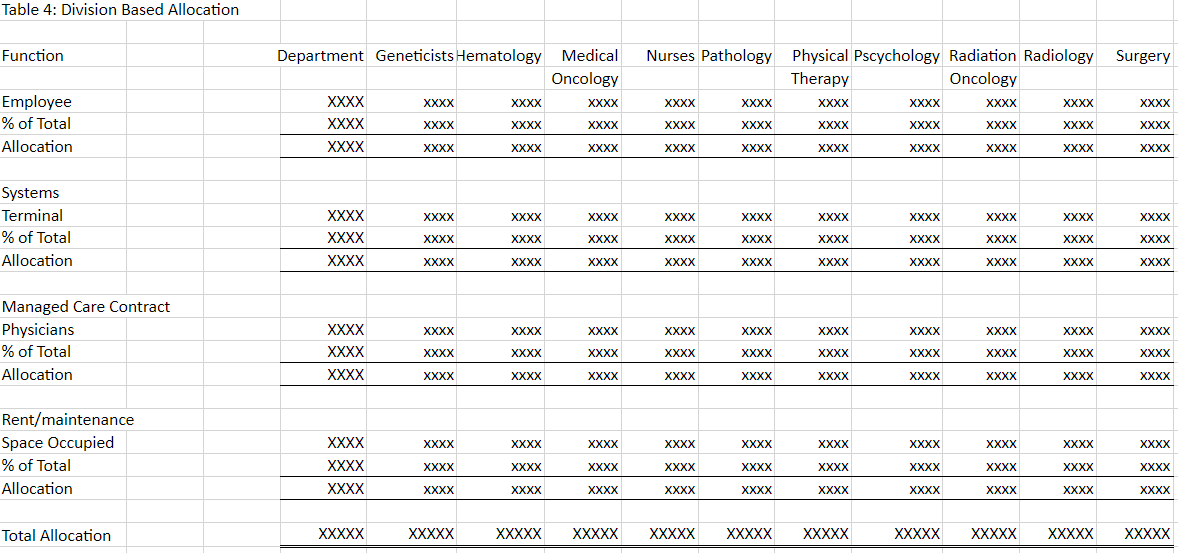

The traditional way of allocating costs would be performed by assigning all services to a centralized expense (this would include data systems, payroll, accounts payable, and managed-care contracts). While this method is accepted, a closer look allows management to allocate expenses by segments that were utilized in an activity-based method. With this method, each segment has a cost driver that helps determine the usage of services to determine how much is actually spent per segment. Four administrative functions that maybe used to divide and determine allocation:

Financial Reporting: Primarily consists of the human resource departments. Their workload is typically determined by the number of full-time employees, so this is a fitting cost driver.

Systems: In essence, is maintenance for the equipment and systems support. Personal computers are commonly the driver.

Managed Care Contracts: Embodied by the staff and system costs but specific to individual physicians. This is an agreement between the physician and the organization. So, the number of physicians in a practice make this cost driver.

Rent and Maintenance: Such costs are generally allocated based on floor space occupied by each of the departments or service divisions

This system of categorization shows the accurate, specific usage of services by each business and enables better decisions concerning compensation for the owner. The activity-based allocation system ensures that each practice is responsible for their own expenses and that the income is directly driven by the management or owner’s decisions enabling each practice to have their own choices for services requisitioned. Table 4 below illustrates what a typical division-based allocation would look like. Again, this can help in making informed management decisions in managing expenses and seeing how they correlate to the revenue generated.

Why it Matters

By reorganizing the traditional income statement to include more details and show a more accurate depiction of the medical practice using the strategic financial information method, more power is brought into the hands of the management and owners to create a better future for the business. While this article outlines a multi-practice line of business, many of the simpler concepts from here can be applied to individual and smaller medical practices. Kislay Shah, CPA is taking the next step forward to allow your business to find solutions by going further than the standard traditional methods. You can reach Shah at or call at 646-328-1326