Presenting Financial Statements of Non-Profits

As of 2017, the Account Standards Update no. 2016-14 concerning non-profit entities was released to initiate five changes to financial statements presented by these organizations. These changes state:

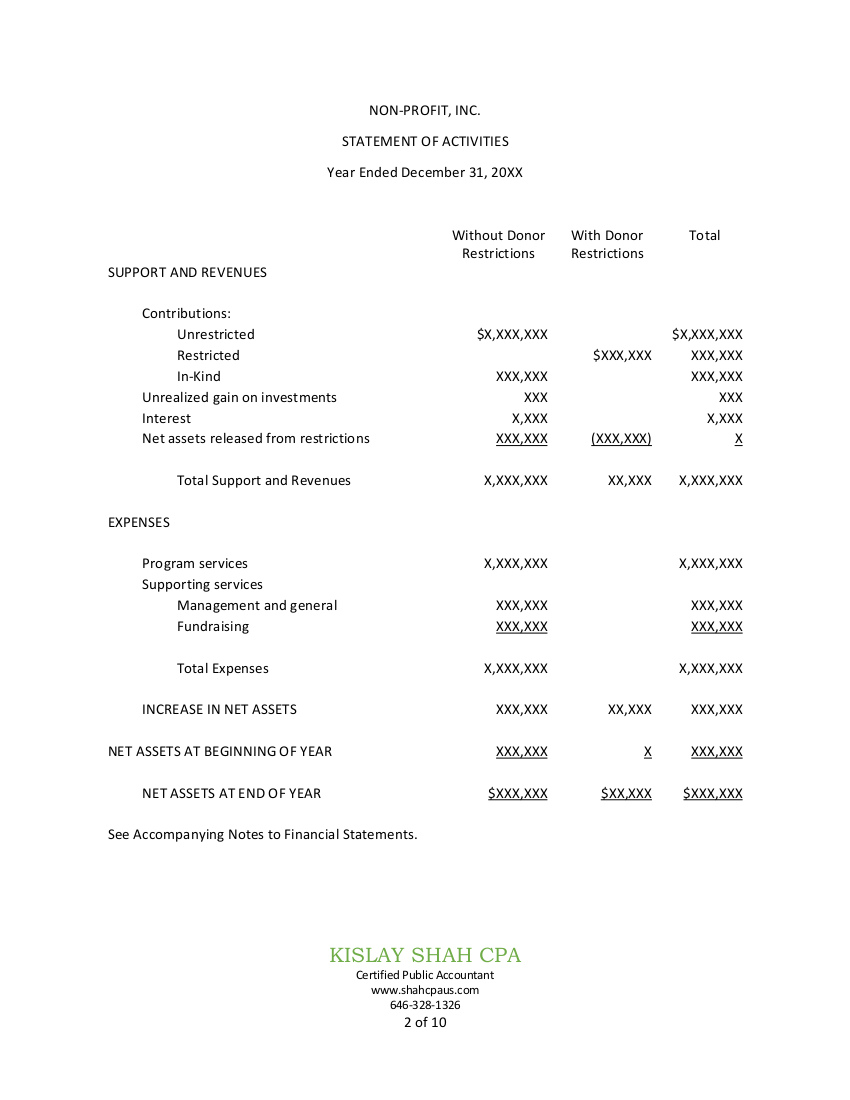

- Net asset classifications decrease from three to two – net assets with donor restrictions versus without donor restrictions.

- Reporting of enhanced disclosures for underwater amounts of donor restricted endowment funds in net assets.

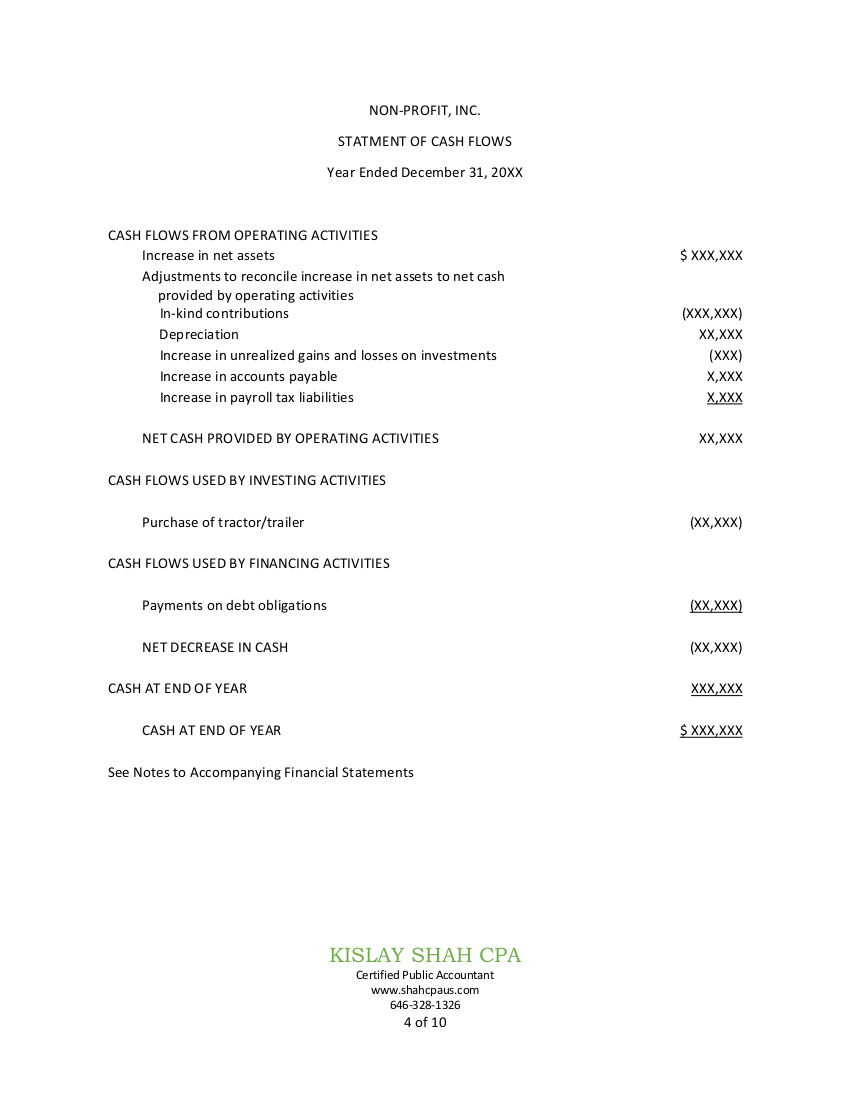

- Presentation of cash flows are reported via the direct or indirect method. With the direct method, indirect reconciliation is eliminated.

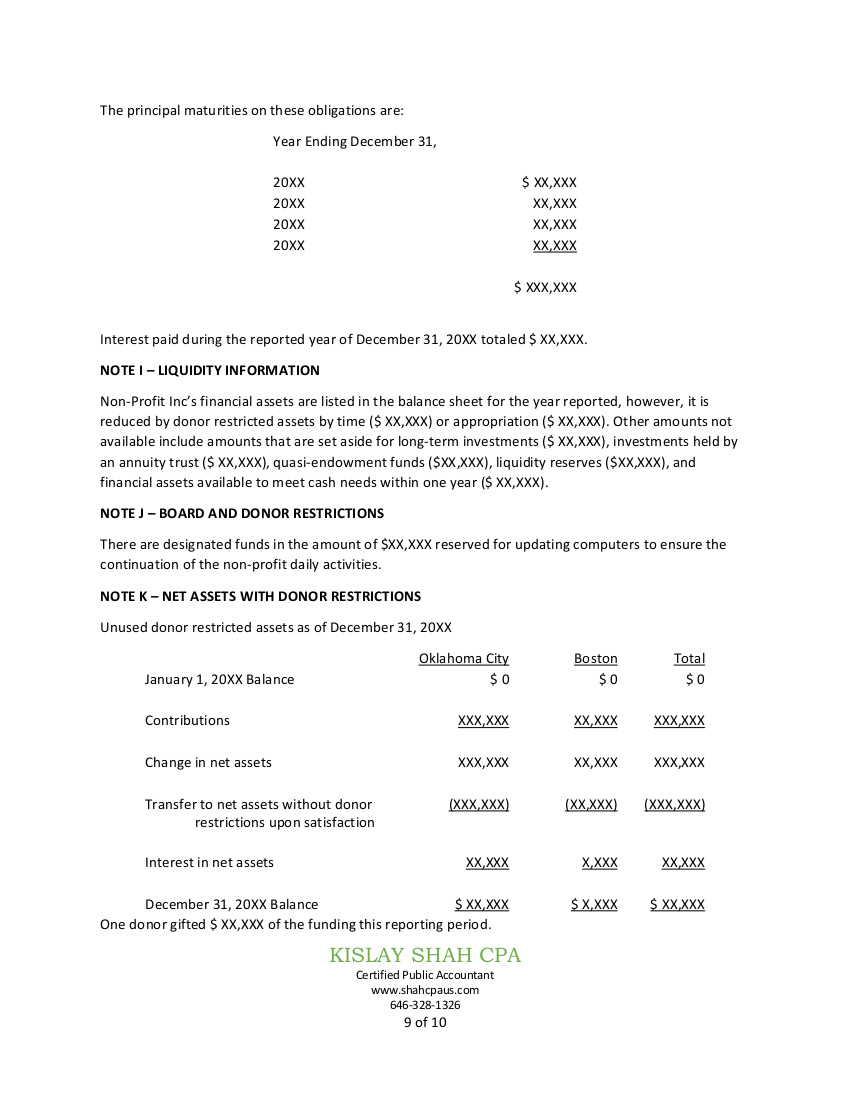

- Notes on management of liquid available resources and liquidity risks require qualitative information. They also require disclosure of financial information about the financial assets available for general expenditures within one year.

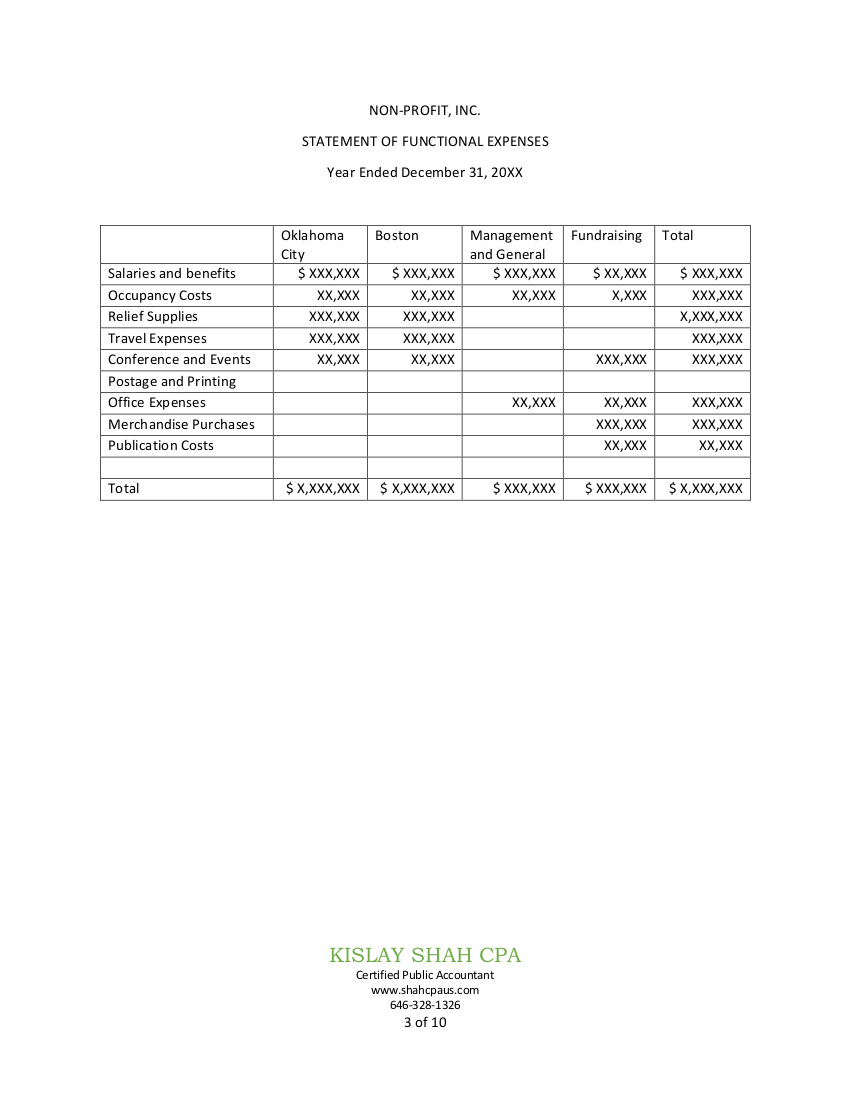

- A separate statement or notes require a statement of functional expenses to be presented.

Parts of a Financial Statement for a Non-Profit

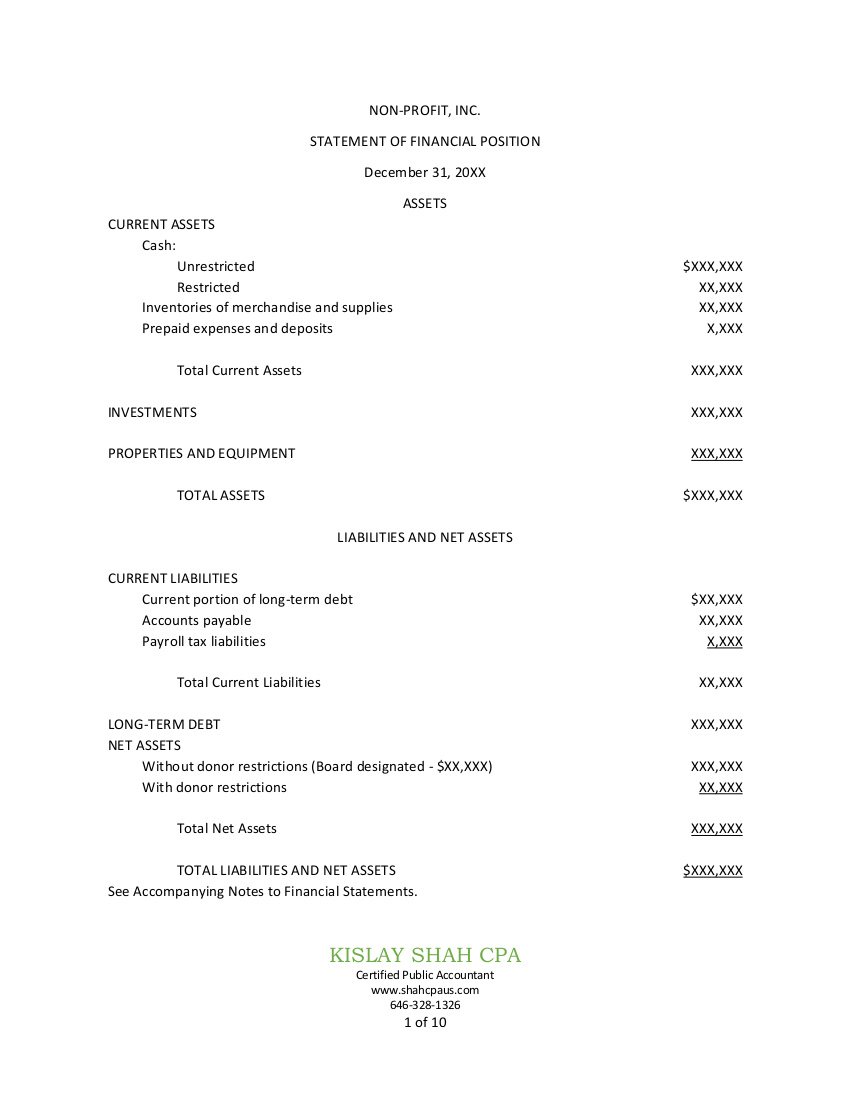

For a non-profit financial statement to be complete, it must contain a statement of financial position, statement of activities, statement of cash flows, and a statement of functional expenses. These assist in giving a full overview to the statement users.

Reporting Guidelines

Depending on the institution and who they rely upon for grants, it will dictate what guidelines they require for their financial statements. When an organization receives federal funding or is an accountability organization, government entity, or a grantor, the organization must follow the generally accepted accounting principles (GAAP) for their financial statements. GAAP is the most preferred method of preparing financial statements and is typically the same for large or small organizations except for some disclosure requirements. However, some entities choose to follow other comprehensive basis of accounting (OCBOA) methods, like the modified cash or income tax basis. Non-profit entities may also choose to follow international financial reporting standards (IFRS) that are recognized by the FASB and the AICPA (American Institue of Certified Public Accountants). When preparing and engaging in reports, these standards must also be accounted for.

Issues with Non-Profit Entities Post COVID-19

Like the rest of the world, COVID-19 had a heavy impact on non-profit organizations. As the world halted, employee and participation activities slowed or completely stopped because of reduced resources. Those in charge of governing these organizations need to take note of key restrictions and resources available to them, such as:

- How can grants be received from decreased contributions?

- Recording loans received from the CARES Act

- When to rehire/end terminations and furloughs

- Revision of internal controls for all employees – new, old, and change of location status

- Is allowance for uncollectible promises to give sufficient?

- Recognition of losses from impairment of investments or tangible/intangible assets

- Recognition, evaluation, and plans of a potential cease of existence of the non-profit

There are many authors and others who are trying to assist these non-profit entities with articles and resources to address the organization’s needs to help get the non-profit back on the proper track post-pandemic.

While there have been changes and new obstacles for non-profit organizations, the overwhelming importance for an entity to present proper financial statements is imperative. Without proper statements, organizations can lose resources and hurt them and the communities they support. This is why having an accountant can be beneficial to the entity. Accountants stay up to date on regulations, so the organizations do not have to. Kislay Shah CPA is able help your organization do all it can do by enabling the non-profit to focus on its mission. You can reach Shah at or call at 646-328-1326.